The Nicklaus empire’s Chinese affiliate has snuggled up to one of the true high flyers in the nation’s golf industry. Nicklaus China, an entity created last year, will lend its development expertise and design talents to the golf operations of Hainan Airlines, which hopes to elevate the quality of its 13 golf properties in China and the United States. “Golf course developers in China are looking for leadership and expertise in the golf and real estate arenas,” Jack Nicklaus noted. According to a press release, the partnership is expected to “lead to the re-design and re-branding of many of the HNA facilities.” The properties to be upgraded haven’t been identified, but HNA Development Company says it owns seven on Hainan Island, among them Kangle Garden International Golf Club and Sun River Golf Club, and four others elsewhere in the People’s Republic. And at one time or another it had also planned to build courses in Chengde (Hebei Province) and Tianjin. Nicklaus’ architectural team is also expected to evaluate the two properties that HNA owns in the United States, starting with the former Pasadera Country Club in Monterey, California, which is now known as Nicklaus Club Monterey. If the name change is a harbinger of things to come, we may soon see the Nicklaus name on other HNA-owned properties, including Somers Pointe Golf Club in Somers, New York.

Some information in the preceding post first appeared in the January 2012 issue of the World Edition of the Golf Course Report.

Mike Keiser’s rumored golf resort in Wisconsin is looking more and more like a sure thing. The resort already has a name, Sand Valley, and Keiser hopes to break ground on its first 18-hole golf course next year. In a conversation with Rory Spears, a Chicago-based radio-show host, Keiser said that he’s “very close to a purchase agreement” for a 1,500-acre spread with the potential to become “the Pine Valley of the Midwest,” except that it may have as many as seven golf courses. A designer for course number one hasn’t yet been selected, but Keiser has whittled his options to four: Tom Doak, Coore & Crenshaw, David McLay Kidd, and Jim Urbina. Keiser says that he won’t build a second course unless the first one attracts 25,000 rounds, but what are the chances of that not happening?

While he formulates plans for his forthcoming golf venture in Wisconsin, Mike Keiser continues to add attractions at his celebrated property in Oregon. Bandon Dunes has begun to offer its guests preview rounds at the Punchbowl, its 3.5-acre putting course. “You will find every kind of putt that you can imagine out there,” Tom Doak said in a comment published by the Eugene Register-Guard, “and probably a few that you’ve never dreamed of.” The course, which was co-designed by Doak and Jim Urbina, has been modeled after similar facilities at St. Andrews in Scotland and the Pinehurst resort in North Carolina. It’ll make its official debut in May 2014.

ClubCorp took home less than anticipated from its initial public offering. The Dallas, Texas-based management firm had been expected to sell its share at $16 to $18, but it ended up asking for just $14. As a result, ClubCorp and its owner, KSL Capital Partners, raised $252 million instead of $300 million or more. ClubCorp didn’t provide a rationale for its pricing, but an online investment analyst, Seeking Alpha, had advised against the purchase, citing “anemic” membership growth, a “very high” valuation, and “a large amount of insider selling.” In the end, ClubCorp sold 13.2 million shares and KSL sold 4.8 million.

KemperSports has been hired to rescue the fast-fading Arlington Club in suburban Lexington, Kentucky. Arlington, a private country club owned by Eastern Kentucky University and whose members consist mostly of alumni, was forced to close its restaurant and catering operation last year. The club’s problem, declining use, has also begun to affect its 44-year-old golf course. A board member concedes that “professional management will benefit the club and our members going forward.” A press release doesn’t say when KemperSports begins its tenure, but its primary task will be to attract new members, particularly young families with children.

Golf clubs in need of revitalization have a new group to call, as a group of Texas-based investors are looking to buy private clubs, provide financing to entities that wish to acquire private clubs, and invest in member-owned private clubs seeking to upgrade their facilities. The recently established group, Millennium Club Partners, is led by Tom Bennison, a golf industry veteran and a former principal of Fore Golf Partners. It doesn’t expect to have a shortage of opportunities, as it believes private clubs in the future must not only offer golf but also “a broad range of family-oriented amenities including resort-style pools, expansive fitness facilities, modern clubhouse décor, and exceptional dining experiences.” Bennison’s partners are Christopher Bancroft, a one-time director of Dow Jones & Company, the entity that formerly owned the Wall Street Journal; John Pigott and Bruce Leadbetter, a pair of Dallas, Texas-based investors; and Harold Handelsman, the legal representative for the Pritzker family.

Signature Group has been enlisted to master-plan the future of a group that aims to become a major player in Asian golf. Tim Trinka believes that Signature can help his Asian Golf Industry Federation become the organization that leads “the responsible development of golf in Asia.” To reach that goal, he says, the AGIF needs to develop “a strategic plan that will offer a successful path for our organization to provide long-term benefits to the industry in the region.” Signature, which is based in Ponte Vedra Beach, Florida, expects to produce the master plan and a “sponsorship engagement program” by the end of the year.

The new owner of IMG Worldwide will have an opportunity to capitalize on the 10-year history of the golf industry’s premier international get-together. IMG has acquired the Golf Business Forum, an annual conference created by KPMG that’s given golf professionals a convenient excuse to visit Italy, Dubai, Scotland, the Czech Republic, and other worthy destinations. Andrea Sartori, the face of the accounting firm’s golf advisory practice, believes that IMG “will help bring new life to the event” and take both it and KPMG’s online Golf Business Community “to new levels.” Forstmann Little, IMG’s owner since 2004, is said to be reviewing offers for its sports management and marketing colossus, which could be worth $2 billion.

The world’s most under-appreciated golf market, Africa, has 828 golf courses, according to CNN. More than half of them -- 450 -- are in South Africa, but the news service reports that 43 of the continents nations have at least one golf course.

Sunday, September 29, 2013

Friday, September 27, 2013

Transactions, september 27, 2013

A family feud has enabled Henry Luken to acquire his fourth golf property in greater Chattanooga, Tennessee. At an auction last month, Luken bid $950,000 for Valleybrook Golf & Country Club in Hixson, which features a Chic Adams-designed golf course. The sellers were the children of Carl Drake, one of Valleybrook’s founders, who were reportedly hoping to get $2 million for the 50-year-old property. The Chattanooga Times Free Press reports that a court ordered the sale “to settle a simmering sibling financial dispute that has dragged on for months.” Luken also owns Eagle Bluff Golf Club in Chattanooga, Montlake Country Club in Soddy-Daisy, and Battlefield Golf Club in Ringgold, Georgia. He hopes to close on his purchase of Valleybrook this month and to make improvements to its course and clubhouse as a prelude to taking it private.

Paulson & Company, a seller of golf properties earlier this year, has become a buyer again. The New York-based hedge fund operator has acquired a majority interest in the Bahia Beach resort community on Puerto Rico’s northeastern coast. Bahia Beach, which occupies 483 acres in the town of Rio Grande, features houses, a St. Regis hotel, and an 18-hole, Robert Trent Jones, Jr.-designed golf course. Paulson’s investment will enable Bahia Beach to continue developing residential real estate and adding amenities. This spring, a bankrupt entity controlled by Paulson sold the Doral resort in Miami, Florida to Donald Trump and three properties in La Quinta, California, among them PGA West and La Quinta Resort, to an investment group controlled by Singapore’s government.

A golf course in Oregon designed and originally owned by Robert Trent Jones, Jr. has been sold to a financial planner from Portland. It’s the first golf acquisition for Bob Hyer, who closed on his purchase of Eagle Point Golf Club outside Medford in late July. “It’s an all-year-round course, and I’m one of those guys that will play in the rain all day long just to be able to play,” he told the Medford Mail Tribune. Hyer doesn’t plan to make any significant changes to Eagle Point’s 17-year-old track, which he believes is “really cool the way it is.” Touchstone Golf has been hired to ensure that it remains so. The seller, PremierWest Bank, took possession of the property in early 2012, when its former owner gave it up in lieu of foreclosure.

Changes are in store at Florida Keys Country Club, where a prospective ownership group plans facility improvements and new development. An entity led by Marvin Rappaport, a developer in the Keys, has contracted to buy the 53-year-old club, which has been suffering from what a board member described to the Florida Keys Keynoter as “age and the recession.” If the sale is consummated, Rappaport plans to upgrade Florida Keys’ Mark Mahannah-designed golf course and build a new clubhouse. The club’s existing clubhouse will be razed and replaced with 13 cottages and a 60-room hotel. “We’re going to have to spend some money to make that course what it should be,” one of Rappaport’s partners told the newspaper. Florida Keys, which was originally known as Sombrero Country Club, once had as many as 200 members. Today it has fewer than 50.

A home builder in Bryan, Texas has agreed to buy the financially troubled Briarcrest Country Club, with the intent of -- surprise! -- maintaining its 18-hole golf course. In fact, Wallace Phillips aims to make improvements to the Marvin Ferguson-designed layout. “The golf course needs some tender loving care and some attention that the club hasn’t been able to afford to do,” Phillips told KBTX-TV. The club has been on the market for more than two years. The city of Bryan had hoped to buy it in 2011, but local voters overwhelmingly rejected the idea. The transaction is expected to close next month. Phillips intends to retain the services of Billy Casper Golf, which has been managing Briarcrest since 2010.

Semiahmoo Resort, once one of the prime vacation destinations in the Pacific Northwest, has reopened under new ownership. An LLC led by Wright Hotels and Jerry Anches, a Seattle-based investor, paid $19.5 million for the 25-year-old, 1,100-acre resort, which features a hotel, a spa, and 18-hole golf courses designed by Arnold Palmer and Graham Cooke. The seller, a group led by the Upper Skagit Indian Tribe, had been trying to sell the property for a year or more before closing everything but the golf courses in late 2012. The new owners have embarked on $7 million in improvements that they hope to complete by the spring of next year.

For the second time in a year, Don Brown has acquired a struggling golf course in South Carolina. Last September, Brown and his wife purchased Bishopville Country Club in Bishopville. This summer, he and two partners bought Oakdale Country Club, a 51-year-old property in Florence that will receive a makeover and a new name, The Palms Course at Oakdale. “By the time we get through with everything we’re going to do,” Brown told the Florence Morning News, “I think this course and club will be as good as any in the area.” The new owners hope to debut a revitalized Oakdale sometime next summer.

Paulson & Company, a seller of golf properties earlier this year, has become a buyer again. The New York-based hedge fund operator has acquired a majority interest in the Bahia Beach resort community on Puerto Rico’s northeastern coast. Bahia Beach, which occupies 483 acres in the town of Rio Grande, features houses, a St. Regis hotel, and an 18-hole, Robert Trent Jones, Jr.-designed golf course. Paulson’s investment will enable Bahia Beach to continue developing residential real estate and adding amenities. This spring, a bankrupt entity controlled by Paulson sold the Doral resort in Miami, Florida to Donald Trump and three properties in La Quinta, California, among them PGA West and La Quinta Resort, to an investment group controlled by Singapore’s government.

A golf course in Oregon designed and originally owned by Robert Trent Jones, Jr. has been sold to a financial planner from Portland. It’s the first golf acquisition for Bob Hyer, who closed on his purchase of Eagle Point Golf Club outside Medford in late July. “It’s an all-year-round course, and I’m one of those guys that will play in the rain all day long just to be able to play,” he told the Medford Mail Tribune. Hyer doesn’t plan to make any significant changes to Eagle Point’s 17-year-old track, which he believes is “really cool the way it is.” Touchstone Golf has been hired to ensure that it remains so. The seller, PremierWest Bank, took possession of the property in early 2012, when its former owner gave it up in lieu of foreclosure.

Changes are in store at Florida Keys Country Club, where a prospective ownership group plans facility improvements and new development. An entity led by Marvin Rappaport, a developer in the Keys, has contracted to buy the 53-year-old club, which has been suffering from what a board member described to the Florida Keys Keynoter as “age and the recession.” If the sale is consummated, Rappaport plans to upgrade Florida Keys’ Mark Mahannah-designed golf course and build a new clubhouse. The club’s existing clubhouse will be razed and replaced with 13 cottages and a 60-room hotel. “We’re going to have to spend some money to make that course what it should be,” one of Rappaport’s partners told the newspaper. Florida Keys, which was originally known as Sombrero Country Club, once had as many as 200 members. Today it has fewer than 50.

A home builder in Bryan, Texas has agreed to buy the financially troubled Briarcrest Country Club, with the intent of -- surprise! -- maintaining its 18-hole golf course. In fact, Wallace Phillips aims to make improvements to the Marvin Ferguson-designed layout. “The golf course needs some tender loving care and some attention that the club hasn’t been able to afford to do,” Phillips told KBTX-TV. The club has been on the market for more than two years. The city of Bryan had hoped to buy it in 2011, but local voters overwhelmingly rejected the idea. The transaction is expected to close next month. Phillips intends to retain the services of Billy Casper Golf, which has been managing Briarcrest since 2010.

Semiahmoo Resort, once one of the prime vacation destinations in the Pacific Northwest, has reopened under new ownership. An LLC led by Wright Hotels and Jerry Anches, a Seattle-based investor, paid $19.5 million for the 25-year-old, 1,100-acre resort, which features a hotel, a spa, and 18-hole golf courses designed by Arnold Palmer and Graham Cooke. The seller, a group led by the Upper Skagit Indian Tribe, had been trying to sell the property for a year or more before closing everything but the golf courses in late 2012. The new owners have embarked on $7 million in improvements that they hope to complete by the spring of next year.

For the second time in a year, Don Brown has acquired a struggling golf course in South Carolina. Last September, Brown and his wife purchased Bishopville Country Club in Bishopville. This summer, he and two partners bought Oakdale Country Club, a 51-year-old property in Florence that will receive a makeover and a new name, The Palms Course at Oakdale. “By the time we get through with everything we’re going to do,” Brown told the Florence Morning News, “I think this course and club will be as good as any in the area.” The new owners hope to debut a revitalized Oakdale sometime next summer.

Sunday, September 22, 2013

The Week That Was, september 22, 2013

An investment group with renewed interest in the golf business has agreed to purchase American Golf Corporation, the one-time titan among U.S. golf course operators. According to the Pellucid Perspective, New York City-based Fortress Investment Group “will likely” pay more than $1.8 billion for AGC, which currently controls fewer than 100 golf properties. Pellucid’s estimate seems high, as a $1.8 billion price suggests that AGC’s mostly pedestrian courses are each worth roughly $18 million. The seller is another investment group, one led by Goldman Sachs and Starwood Capital Group. The Sachs/Starwood entity bought AGC in 2003, when it was the world’s largest owner/operator of golf properties, and subsequently disposed of more than half of AGC’s portfolio. Assuming that the transaction closes, it’ll be Fortress’ second investment in the U.S. golf industry this year. In July, it became a financier for Arcis Equity Partners, a freshly minted golf investment group from Irving, Texas. Fortress, a hedge fund operator, has since 2006 owned Intrawest, a Denver, Colorado-based resort owner and operator that once had well over a dozen golf properties among its holdings. Fortress has sold all but four, two of them in Canada. If all this history is any guide, you can expect AGC’s portfolio to shrink a bit more in the future, as Fortress attempts to squeeze out profits from its assets.

The repressive military regime that controls Fiji has claimed one of the richest events on the Asian golf tours. The PGA Tour of Australasia has created a $1 million event, the Fiji International, for the banana republic, which has since 2006 been ruled by a despot, Commodore Josaia Voreqe Bainimarama. (Everyone calls him Frank.) The Fiji International, which has been sanctioned by OneAsia, will get a five-year run at Natadola Bay Championship Golf Course beginning in August 2014. OneAsia’s chairman, Sang Y. Chun, thinks the tournament “will very quickly become one of the most popular destinations on tour.” Bainimarama believes it’ll give him “a fantastic avenue to promote our beautiful nation and show the world what we have to offer.” What Fiji has to offer, according to Yahoo! Sports, is a government that “has been shunned by the international community for tearing up the Pacific nation’s constitution, sacking the judiciary, and tightening media censorship as well as reneging on promises to hold elections in 2009.”

Pacific Links International, the Chinese-Canadian company that’s rapidly building its U.S. golf portfolio, appears poised to acquire its third golf property in greater Las Vegas, Nevada. The Las Vegas Review-Journal reports that PLI is negotiating to buy DragonRidge Country Club in Henderson, a 12-year old property that features an 18-hole course co-designed by Jay Morrish and David Druzisky. “There’s no full-blown contract yet, but we’re getting close,” DragonRidge’s owner told the newspaper. PLI, a group led by Du Sha, purchased SouthShore Golf Club and Southern Highlands Golf Club in 2011. It aims to collect at least five properties in the Vegas area, so it can offer a week-long package of golf play to the people in its fast-growing membership club. “We want to buy clusters of golf courses in strategic markets,” Harry Turner, a PLI vice president, explained. PLI also owns five courses in Hawaii and one each in California and West Virginia, and Turner acknowledged that it’s on the prowl for properties in the suburbs of New York City.

What are the chances that Cabot Links, the top-rated golf course in Canada and Golf magazine’s #82 in the world, is upstaged by the resort’s forthcoming Coore & Crenshaw-designed layout? Robert Thompson, who recently toured the construction site in Inverness, Nova Scotia, writes that the new Cabot Cliffs course “will likely have more drama, more excitement, and more variety than Cabot Links” and ultimately receive a higher ranking. “I have a distinct feeling Cabot Links will only hold the distinction of being the best in Canada for another couple of years,” Thompson writes in a blog post for Canadian Golfer. “After that, all the talk will focus on Cabot Cliffs.” The Cliffs’ advantage, Thompson believes, is its perch overlooking the Atlantic and the variety of its landscape. “Pebble Beach meets Pacific Dunes,” he calls it. Of course, Thompson is evaluating a work in progress, not a finished product. But if he’s right, Mike Keiser and Ben Cowan-Dewar are going to need a bigger hotel.

Hud Hinton and the principals of Affiniti Golf Partners have teamed up to create a new management group. Mosaic Clubs & Resorts aims to operate “the world’s most prestigious private and resort clubs,” according to a press release, and promises to deliver “first-class golf experiences, unsurpassed service, state-of-the-art marketing and websites, superior staff training, and exceptional client attention.” Mosaic begins its existence with two properties in Georgia, Waterfall Club in Clayton and The Manor Golf & Country Club in Alpharetta. Both had previously been managed by Affiniti, a group created by Whitney Crouse and Steve Willy. Hinton, who spent a short time as the CEO of Troon Golf and who was once considered by Golf, Inc. to be among the most powerful people in the golf industry, will be Mosaic’s CEO. “I joined Whitney and Steve because I saw the chance to create another major golf company,” he said. Mosaic will manage less prestigious properties with what the press release calls “an Affiniti banner.”

The premier golf operator in Myrtle Beach doesn’t pay its employees the minimum wage or overtime pay, according to a lawsuit filed by a former employee. The lawsuit alleges that National Golf Management LLC, an entity created via a merger of Burroughs & Chapin Golf Management and Myrtle Beach National Company, paid a bag-drop attendant only $5.80 an hour -- the minimum wage is $7.25 -- and refused to pay him overtime even though he routinely worked 50 or more hours a week. If the allegation is true, the operators have violated federal law. The management firms haven’t commented on the matter, and no court hearings have yet been scheduled. National Golf Management owns 15 courses and manages eight others, and The State reports that it books about 60 percent of the tee times made along the Grand Strand.

Arnold Palmer Golf Management’s golf properties in New York have been pocketing tips intended for waiters, bartenders, and other service personnel, according to a complaint filed by a national law firm. Faruqi & Faruqi LLP alleges that the management group, an affiliate of Century Golf Partners, adds a 20 percent service charge to banquet bills but doesn’t give the money to the clubs’ staffers. The law firm is working on behalf of two employees at Fox Valley Club in Lancaster, a property reportedly owned by Palmer. The plaintiffs aim to recover the gratuities they believe they deserve, along with gratuities that should have been paid to employees at two other clubs operated by APGM. As of press time, neither Palmer nor Century Golf had responded to the complaint.

In an effort to grow the game among women, Billy Casper Golf has acquired a golf-networking group that is said to remove “the intimidating barriers that cause females to overlook the game.” BCG now controls Women on Course, a three-year-old organization that’s dedicated partly to golf but mostly to what a press release calls “the golf lifestyle.” Women on Course hosts three-day golf weekends for women at resorts from coast to coast as well as “golf, lunch, happy hour, and wine-spa activities” in major metropolitan areas. The group says that one-third of the attendees at these events have “very little knowledge of the game.” Donna Hoffman, the group’s founder, believes that BCG “is perfectly suited to exponentially grow Women on Course, so even more women will experience the business, social, and fitness benefits connected to golf.” There’s plenty of room for growth in this market, for women, who constitute nearly 51 percent of the U.S. population, constitute less than 20 percent of U.S. golfers.

Gil Hanse recently told 7 Days in Dubai that the Old Course at St. Andrews is “the pinnacle” of golf design and that Augusta National is “as good as everyone says it is.” He also talked about the course he’s designing for Donald Trump and Damac Properties in Dubai, which he describes as “a desert course with an element of links golf.” As he’s done previously, he acknowledges that he’s “pushing a lot of sand around” to create a track capable of hosting events on the European Tour. “It will be creative and interesting to play,” he promises. “I want the experience to be a mixture of fun and interesting, and the course to be full of variety and character.” One thing’s for sure: There won’t be a hole at Trump International Golf Club Dubai as difficult as the 18th at Doral’s Blue Monster course. Hanse, who’s wrapping up a renovation of the Blue Monster, says that number 18 is “as hard a hole as you can play” and “the only hole we left untouched.”

The repressive military regime that controls Fiji has claimed one of the richest events on the Asian golf tours. The PGA Tour of Australasia has created a $1 million event, the Fiji International, for the banana republic, which has since 2006 been ruled by a despot, Commodore Josaia Voreqe Bainimarama. (Everyone calls him Frank.) The Fiji International, which has been sanctioned by OneAsia, will get a five-year run at Natadola Bay Championship Golf Course beginning in August 2014. OneAsia’s chairman, Sang Y. Chun, thinks the tournament “will very quickly become one of the most popular destinations on tour.” Bainimarama believes it’ll give him “a fantastic avenue to promote our beautiful nation and show the world what we have to offer.” What Fiji has to offer, according to Yahoo! Sports, is a government that “has been shunned by the international community for tearing up the Pacific nation’s constitution, sacking the judiciary, and tightening media censorship as well as reneging on promises to hold elections in 2009.”

Pacific Links International, the Chinese-Canadian company that’s rapidly building its U.S. golf portfolio, appears poised to acquire its third golf property in greater Las Vegas, Nevada. The Las Vegas Review-Journal reports that PLI is negotiating to buy DragonRidge Country Club in Henderson, a 12-year old property that features an 18-hole course co-designed by Jay Morrish and David Druzisky. “There’s no full-blown contract yet, but we’re getting close,” DragonRidge’s owner told the newspaper. PLI, a group led by Du Sha, purchased SouthShore Golf Club and Southern Highlands Golf Club in 2011. It aims to collect at least five properties in the Vegas area, so it can offer a week-long package of golf play to the people in its fast-growing membership club. “We want to buy clusters of golf courses in strategic markets,” Harry Turner, a PLI vice president, explained. PLI also owns five courses in Hawaii and one each in California and West Virginia, and Turner acknowledged that it’s on the prowl for properties in the suburbs of New York City.

What are the chances that Cabot Links, the top-rated golf course in Canada and Golf magazine’s #82 in the world, is upstaged by the resort’s forthcoming Coore & Crenshaw-designed layout? Robert Thompson, who recently toured the construction site in Inverness, Nova Scotia, writes that the new Cabot Cliffs course “will likely have more drama, more excitement, and more variety than Cabot Links” and ultimately receive a higher ranking. “I have a distinct feeling Cabot Links will only hold the distinction of being the best in Canada for another couple of years,” Thompson writes in a blog post for Canadian Golfer. “After that, all the talk will focus on Cabot Cliffs.” The Cliffs’ advantage, Thompson believes, is its perch overlooking the Atlantic and the variety of its landscape. “Pebble Beach meets Pacific Dunes,” he calls it. Of course, Thompson is evaluating a work in progress, not a finished product. But if he’s right, Mike Keiser and Ben Cowan-Dewar are going to need a bigger hotel.

Hud Hinton and the principals of Affiniti Golf Partners have teamed up to create a new management group. Mosaic Clubs & Resorts aims to operate “the world’s most prestigious private and resort clubs,” according to a press release, and promises to deliver “first-class golf experiences, unsurpassed service, state-of-the-art marketing and websites, superior staff training, and exceptional client attention.” Mosaic begins its existence with two properties in Georgia, Waterfall Club in Clayton and The Manor Golf & Country Club in Alpharetta. Both had previously been managed by Affiniti, a group created by Whitney Crouse and Steve Willy. Hinton, who spent a short time as the CEO of Troon Golf and who was once considered by Golf, Inc. to be among the most powerful people in the golf industry, will be Mosaic’s CEO. “I joined Whitney and Steve because I saw the chance to create another major golf company,” he said. Mosaic will manage less prestigious properties with what the press release calls “an Affiniti banner.”

The premier golf operator in Myrtle Beach doesn’t pay its employees the minimum wage or overtime pay, according to a lawsuit filed by a former employee. The lawsuit alleges that National Golf Management LLC, an entity created via a merger of Burroughs & Chapin Golf Management and Myrtle Beach National Company, paid a bag-drop attendant only $5.80 an hour -- the minimum wage is $7.25 -- and refused to pay him overtime even though he routinely worked 50 or more hours a week. If the allegation is true, the operators have violated federal law. The management firms haven’t commented on the matter, and no court hearings have yet been scheduled. National Golf Management owns 15 courses and manages eight others, and The State reports that it books about 60 percent of the tee times made along the Grand Strand.

Arnold Palmer Golf Management’s golf properties in New York have been pocketing tips intended for waiters, bartenders, and other service personnel, according to a complaint filed by a national law firm. Faruqi & Faruqi LLP alleges that the management group, an affiliate of Century Golf Partners, adds a 20 percent service charge to banquet bills but doesn’t give the money to the clubs’ staffers. The law firm is working on behalf of two employees at Fox Valley Club in Lancaster, a property reportedly owned by Palmer. The plaintiffs aim to recover the gratuities they believe they deserve, along with gratuities that should have been paid to employees at two other clubs operated by APGM. As of press time, neither Palmer nor Century Golf had responded to the complaint.

In an effort to grow the game among women, Billy Casper Golf has acquired a golf-networking group that is said to remove “the intimidating barriers that cause females to overlook the game.” BCG now controls Women on Course, a three-year-old organization that’s dedicated partly to golf but mostly to what a press release calls “the golf lifestyle.” Women on Course hosts three-day golf weekends for women at resorts from coast to coast as well as “golf, lunch, happy hour, and wine-spa activities” in major metropolitan areas. The group says that one-third of the attendees at these events have “very little knowledge of the game.” Donna Hoffman, the group’s founder, believes that BCG “is perfectly suited to exponentially grow Women on Course, so even more women will experience the business, social, and fitness benefits connected to golf.” There’s plenty of room for growth in this market, for women, who constitute nearly 51 percent of the U.S. population, constitute less than 20 percent of U.S. golfers.

Gil Hanse recently told 7 Days in Dubai that the Old Course at St. Andrews is “the pinnacle” of golf design and that Augusta National is “as good as everyone says it is.” He also talked about the course he’s designing for Donald Trump and Damac Properties in Dubai, which he describes as “a desert course with an element of links golf.” As he’s done previously, he acknowledges that he’s “pushing a lot of sand around” to create a track capable of hosting events on the European Tour. “It will be creative and interesting to play,” he promises. “I want the experience to be a mixture of fun and interesting, and the course to be full of variety and character.” One thing’s for sure: There won’t be a hole at Trump International Golf Club Dubai as difficult as the 18th at Doral’s Blue Monster course. Hanse, who’s wrapping up a renovation of the Blue Monster, says that number 18 is “as hard a hole as you can play” and “the only hole we left untouched.”

Friday, September 20, 2013

Vital Signs, september 20, 2013

A million gallons -- that’s how much water each of the 124 golf courses in California’s Coachella Valley uses, on average, every day. The courses are literally sucking the valley dry, according to an in-depth report on water use by the Desert Sun. To keep their turf lush and green, the valley’s courses consume roughly one-quarter of the water pumped from local wells, and the newspaper says their voracious water use is “contributing significantly to declines in groundwater levels and posing long-term dilemmas for public officials charged with overseeing the water supply.” Believe it or not, today only 19 courses in the valley use treated water. Eventually, local water-district officials hope to provide reclaimed water (or water from the Colorado River) to 102 courses, but so far the process has been painfully slow. Can the conversion be done before the area’s residents decide that other thirsts are more important?

More than 1,400 U.S. golf facilities have closed since 2001, and, as one might guess, the dearly departed are mostly nine-hole daily-fee courses that charged “affordable” rates. Premium-priced public spreads, tracks that anchor private clubs, and courses that are part of golf communities have higher survival rates, according to an analysis by the National Golf Foundation. In fact, private clubs, which the NGF says constitute one-quarter of the nation’s existing stock, have, despite their well-documented troubles, so far represented only 8 percent of the total closures. The smaller, “affordable” courses are disproportionately biting the bullet, the NGF explains, as a result of price pressures that are trickling down from the top end of the market. As the high-end courses cut their greens fees to remain viable, the mid-priced courses are forced to follow suit, and then the weakest low-cost courses, desperately scrambling for the few remaining dollars in the market, are squeezed to extinction. In business school, it’s what they call “a vicious cycle.”

Old Man Winter delayed the start of the 2013 golf season, and rainy days this spring and summer reduced the number of rounds that could be played at courses in many parts of the nation. Still, municipalities in three different U.S. regions are reporting results they can live with, and they may even have reason to be optimistic about 2014.

-- This summer, especially in July, cash registers rang happily at Gypsum Creek Golf Course in Colorado’s Vail Valley. “July was the busiest month in the history of the golf course, in terms of both revenue and rounds played,” the course’s director of golf, Tom Buzbee, told the Vail Daily. Gypsum Creek was formerly the centerpiece of the private Cotton Ranch Golf Club, which the town of Gypsum purchased out of foreclosure in 2010. The course now offers some of the lowest rates in an area where golf is pricey, as its weekend greens fees top out at $54, cart included. Buzbee described 2012’s results as “good” and noted that “we exceeded all of them” in 2013.

-- Capital improvements, some advertising, and significant budget cuts have improved the fortunes of the park district-owned golf courses in Springfield, Ohio. The president of the Springfield Golf Association believes that course conditions at the Reid and Snyder Park facilities have improved “vastly.” The properties’ pro thinks “we’ve turned the page and we’re headed in the right direction.” The courses still require subsidies, however, and the park district may eventually close one to save money. “We’re a little under where we’ve been, but we’ll see where we end up,” the park district’s director told the Springfield Sun News. “Nothing will be decided until we get through this season.”

-- The municipal course in Conyers, Georgia appears to be on the verge of trading red ink for black. The number of rounds played at Cherokee Run Golf Course has increased from 10,000 in 2010-11 to roughly 18,000 in 2012-13, and the number of events booked in the property’s clubhouse has doubled. Over the same period, losses have been shaved from $1 million to $224,000. “The golf business is entertainment,” Conyers’ city manager told the Rockdale News. “When a family’s budget gets tight, the first thing to go is entertainment.” According to the newspaper, city officials believe that the course could become profitable “as early as this coming fiscal year.”

Over the next three years, tourism officials in New Zealand plan to invest up to $2 million in marketing programs designed to attract golf travelers. The aim is to boost the amount of money currently spent by golf tourists, $145 million, to $223 million, an increase of more than 53 percent. “New Zealand is a distinctive but largely undiscovered destination for golf enthusiasts,” said a spokesman for Tourism New Zealand. Specifically, Tourism New Zealand intends to target golfers from Australia, North America, and China. It may also create “golf trails” on the nation’s north and south islands to make vacation planning easier.

“Golf is developing strongly and gets more popular” in Vietnam, according to an Asian news service. Xinhua reports that the nation now has 31 courses and roughly 10,000 “regular” golfers.

More than 1,400 U.S. golf facilities have closed since 2001, and, as one might guess, the dearly departed are mostly nine-hole daily-fee courses that charged “affordable” rates. Premium-priced public spreads, tracks that anchor private clubs, and courses that are part of golf communities have higher survival rates, according to an analysis by the National Golf Foundation. In fact, private clubs, which the NGF says constitute one-quarter of the nation’s existing stock, have, despite their well-documented troubles, so far represented only 8 percent of the total closures. The smaller, “affordable” courses are disproportionately biting the bullet, the NGF explains, as a result of price pressures that are trickling down from the top end of the market. As the high-end courses cut their greens fees to remain viable, the mid-priced courses are forced to follow suit, and then the weakest low-cost courses, desperately scrambling for the few remaining dollars in the market, are squeezed to extinction. In business school, it’s what they call “a vicious cycle.”

Old Man Winter delayed the start of the 2013 golf season, and rainy days this spring and summer reduced the number of rounds that could be played at courses in many parts of the nation. Still, municipalities in three different U.S. regions are reporting results they can live with, and they may even have reason to be optimistic about 2014.

-- This summer, especially in July, cash registers rang happily at Gypsum Creek Golf Course in Colorado’s Vail Valley. “July was the busiest month in the history of the golf course, in terms of both revenue and rounds played,” the course’s director of golf, Tom Buzbee, told the Vail Daily. Gypsum Creek was formerly the centerpiece of the private Cotton Ranch Golf Club, which the town of Gypsum purchased out of foreclosure in 2010. The course now offers some of the lowest rates in an area where golf is pricey, as its weekend greens fees top out at $54, cart included. Buzbee described 2012’s results as “good” and noted that “we exceeded all of them” in 2013.

-- Capital improvements, some advertising, and significant budget cuts have improved the fortunes of the park district-owned golf courses in Springfield, Ohio. The president of the Springfield Golf Association believes that course conditions at the Reid and Snyder Park facilities have improved “vastly.” The properties’ pro thinks “we’ve turned the page and we’re headed in the right direction.” The courses still require subsidies, however, and the park district may eventually close one to save money. “We’re a little under where we’ve been, but we’ll see where we end up,” the park district’s director told the Springfield Sun News. “Nothing will be decided until we get through this season.”

-- The municipal course in Conyers, Georgia appears to be on the verge of trading red ink for black. The number of rounds played at Cherokee Run Golf Course has increased from 10,000 in 2010-11 to roughly 18,000 in 2012-13, and the number of events booked in the property’s clubhouse has doubled. Over the same period, losses have been shaved from $1 million to $224,000. “The golf business is entertainment,” Conyers’ city manager told the Rockdale News. “When a family’s budget gets tight, the first thing to go is entertainment.” According to the newspaper, city officials believe that the course could become profitable “as early as this coming fiscal year.”

Over the next three years, tourism officials in New Zealand plan to invest up to $2 million in marketing programs designed to attract golf travelers. The aim is to boost the amount of money currently spent by golf tourists, $145 million, to $223 million, an increase of more than 53 percent. “New Zealand is a distinctive but largely undiscovered destination for golf enthusiasts,” said a spokesman for Tourism New Zealand. Specifically, Tourism New Zealand intends to target golfers from Australia, North America, and China. It may also create “golf trails” on the nation’s north and south islands to make vacation planning easier.

“Golf is developing strongly and gets more popular” in Vietnam, according to an Asian news service. Xinhua reports that the nation now has 31 courses and roughly 10,000 “regular” golfers.

Sunday, September 15, 2013

The Week That Was, september 15, 2013

ClubCorp Holdings has released details about its initial public offering, the headline being that the effort could bring it $300 million or more. ClubCorp will offer 10.9 million shares, according to an SEC filing, and its owner, KSL Capital Partners, will offer 7.1 million shares. At $17, the midway point between the issue’s expected $16 to $18 price per share, a sellout would raise $306 million. When all is said and done, KSL Capital will retain its majority stake ClubCorp, which the Dallas Morning News says owns and/or operates 152 golf, country, and other clubs in North America and also owns the real estate at 81 of its golf and country clubs. ClubCorp plans to use the money it raises to retire roughly $160 million in debt, according to a report by Law 360. In its 2012 fiscal year, the company posted a net loss of $27 million on revenues of $755 million. Had it not been required to cover $89 million in interest expenses, it would have shown a profit.

Golf and housing -- is their relationship still on the rocks, or is there hope of a reconciliation? Henry DeLozier, who once developed golf communities for Pulte Homes, believes that the reinvigorated U.S. housing industry will have a significant influence on future golf development. “Developers and home builders, as they have for decades, will continue to view golf courses and country clubs as primary amenities for many of their projects,” he writes in an essay published by Golf Course Industry. Begging to differ, the Fiscal Times contends that the fortunes of golf-related real estate are on a “downswing” due to overbuilding, the high cost of maintenance, and other factors, including a growing preference for amenities such as lakes, hiking trails, organic gardens, and yoga centers. Its conclusion: “Experts believe that golf as a primary home amenity is in a decline that may be permanent.” Based on these conflicting views, can anyone predict where this marriage of convenience is headed?

IMG Worldwide, the sports management and marketing colossus, is for sale and could fetch $2 billion. Forstmann Little, which reportedly paid $750 million for IMG in 2004, expects to begin reviewing offers later this month, and it’ll likely get several of them, for Carlyle Group, Bain Capital, KKR, William Morris Endeavor Entertainment, and Creative Artists Agency are said to be weighing bids. “We’re a market leader in almost every business we’re in,” George Pyne, the president of IMG Sports, noted earlier this year. Since a $2 billion price tag excludes many prospective buyers, Forstmann Little could choose to sell the company division by division, an approach that could conceivably net even more. Alternately, IMG’s new owner could spin off a few high-profile divisions once the transaction is completed. If IMG’s golf division become available, it would entice many suitors, as it has its fingers in many pies. It manages the careers of a parade of professional golfers, among them Ernie Els, Luke Donald, Colin Montgomerie, Annika Sorenstam, and Michelle Wie. In one way or another, it’s involved with 37 international professional events, including 15 on the PGA and LPGA tours and the Australian Masters, the Ricoh Women’s British Open, and the Abu Dhabi HSBC Golf Championship. In addition, IMG Golf owns and manages golf properties, and its design wing has produced dozens of tracks in countries too numerous to list. Whoever ends up owning it will have a nice slice of the golf business.

Two months after it ran out of money and closed, Golf Club at Summerbrooke has reopened with a new operator. Keith Pope, the principal of Pope Golf Management, has assumed control of the 20-year-old club in Tallahassee, Florida. Pope plans to address greens-related issues immediately and to completely overhaul Summerbrooke’s 18-hole, Dean Refram-designed course over the next three years. “He is like an angel,” Summerbrook’s owner, Reagan Hobbs, told the Tallahassee Democrat. “His forte is turning around courses. He is what we needed.” Hobbs bought Summerbrooke in 2003 and says that it hasn’t had even one profitable year. He was forced to close the club in July due to what the Democrat calls “persistent operating debt.” Pope, which operates six other golf properties in Florida, replaced Hampton Golf Management.

In an attempt to create a destination-worthy venue, the new owner of a golf club in Boothbay, Maine has turned to one of Tom Doak’s former associates. Paul Coulombe has allotted $4 million for a makeover of Boothbay Harbor Country Club, a property he purchased earlier this year, after it failed to sell at an auction. The club features an 18-hole track whose original nine opened in 1921. “I want this course to become a destination course in Maine,” Coulombe told the Boothbay Register. “I hope my investment will spur others to invest in our region.” The work, which begins next month, will be overseen by Bruce Hepner, an architect with minimalist sympathies who operates out of an office near Doak’s in Traverse City, Michigan. Hepner says that his goal is to make the course “strategic, interesting, and playable.”

KemperSports has added one of the top golf properties in Illinois to its fast-growing portfolio of private clubs. The company has been hired to operate Bull Valley Golf Club, a 25-year-old property in exurban Chicago that narrowly avoided foreclosure last year. “There are not a lot of courses in Chicago that can match the character of what Bull Valley has,” Doug Hellman, a senior vice president at KemperSports, told the Northwest Herald. “We’ll make it well worth the effort to go the extra distance to get to Bull Valley.” Specifically, KemperSports has been directed to improve Bull Valley’s food and beverage offerings and to make the club “a premier destination for weddings and parties,” the newspaper says. “We’re focusing on events,” said Gary Rabine, who paid less than $2 million for the club in 2012, “and [Kemper is] going to take that to another level.” Bull Valley is the 15th private club in the Kemper Collection, a group that includes Prairie Club in Valentine, Nebraska; Hamilton Farm Golf Club in Gladstone, New Jersey; and Governors Club in Brentwood, Tennessee.

Rees Jones, whose career achievements include major awards from the American Society of Golf Course Architects and the Golf Course Superintendents Association of America, is about to be recognized for his service to golf by the Golf Course Builders Association of America. The GCBAA plans to award the Montclair, New Jersey-based designer with its Don A. Rossi Award at next year’s Golf Industry Show. “Rees has a unique opinion when it comes to building golf courses and believes courses don’t have to be long to be challenging or hard to be fun,” said Justin Apel, the GCBAA’s executive director. “He was ahead of his time, as this way of thinking has essentially become the mantra of the golf industry.” Jones, a golf course architect since 1965 and a son of Robert Trent Jones, has designed numerous courses in the United States and others in Canada, Mexico, England, China, Namibia, Spain, and Puerto Rico, but he made his reputation -- and earned a nickname, “the Open Doctor” -- for the redesigns and remodelings he did at tracks that host the U.S. Open, the PGA Championship, the Ryder Cup, and other high-profile professional events. The ASGCA gave him the Donald Ross Award in 2013, and the GCSAA gave him the Old Tom Morris Award in 2004.

In coming years, we’re going to be deluged with messages reminding us that Scotland is “the Home of Golf” and inviting us to drop by for a visit. The promotions will be part of a national initiative, Driving Forward Together, whose goal is to make Scotland the world’s top golf destination by 2020. The campaign will be considered a success if it can increase the £220 million ($349 million) that golf currently contributes to the Scottish economy by 20 percent, to roughly £300 million ($476 million). “The collaborative approach between various organizations in pulling this strategy together is exactly what Scotland’s golf tourism sector requires,” said Tourism Minister Fergus Ewing, “and demonstrates that we are all working towards one single aim: to make Scotland the must-visit destination for every golfer.” The campaign will be bolstered by three high-profile events -- the 2014 Ryder Cup and the Open Championships of 2015 and 2016 -- that will be played in Scotland.

If a Canadian group’s calculations about net worth are accurate, Arnold Palmer and Tiger Woods are, among golfers, in a class of their own. Palmer is worth $675 million, according to The Richest, while Woods is worth $600 million. Greg Norman is a distant third ($300 million), followed closely by Jack Nicklaus ($280 million) and distantly by Phil Mickelson ($180 million). The rest of the top 10 looks like this: Fred Couples ($105 million), Ernie Els ($75 million), Vijay Singh ($65 million), Nick Faldo ($51 million), and Jim Furyk ($50 million). One surprise: Steve Williams, the caddy for Adam Scott (and, formerly, Woods), is said to be worth $20 million.

Golf and housing -- is their relationship still on the rocks, or is there hope of a reconciliation? Henry DeLozier, who once developed golf communities for Pulte Homes, believes that the reinvigorated U.S. housing industry will have a significant influence on future golf development. “Developers and home builders, as they have for decades, will continue to view golf courses and country clubs as primary amenities for many of their projects,” he writes in an essay published by Golf Course Industry. Begging to differ, the Fiscal Times contends that the fortunes of golf-related real estate are on a “downswing” due to overbuilding, the high cost of maintenance, and other factors, including a growing preference for amenities such as lakes, hiking trails, organic gardens, and yoga centers. Its conclusion: “Experts believe that golf as a primary home amenity is in a decline that may be permanent.” Based on these conflicting views, can anyone predict where this marriage of convenience is headed?

IMG Worldwide, the sports management and marketing colossus, is for sale and could fetch $2 billion. Forstmann Little, which reportedly paid $750 million for IMG in 2004, expects to begin reviewing offers later this month, and it’ll likely get several of them, for Carlyle Group, Bain Capital, KKR, William Morris Endeavor Entertainment, and Creative Artists Agency are said to be weighing bids. “We’re a market leader in almost every business we’re in,” George Pyne, the president of IMG Sports, noted earlier this year. Since a $2 billion price tag excludes many prospective buyers, Forstmann Little could choose to sell the company division by division, an approach that could conceivably net even more. Alternately, IMG’s new owner could spin off a few high-profile divisions once the transaction is completed. If IMG’s golf division become available, it would entice many suitors, as it has its fingers in many pies. It manages the careers of a parade of professional golfers, among them Ernie Els, Luke Donald, Colin Montgomerie, Annika Sorenstam, and Michelle Wie. In one way or another, it’s involved with 37 international professional events, including 15 on the PGA and LPGA tours and the Australian Masters, the Ricoh Women’s British Open, and the Abu Dhabi HSBC Golf Championship. In addition, IMG Golf owns and manages golf properties, and its design wing has produced dozens of tracks in countries too numerous to list. Whoever ends up owning it will have a nice slice of the golf business.

Two months after it ran out of money and closed, Golf Club at Summerbrooke has reopened with a new operator. Keith Pope, the principal of Pope Golf Management, has assumed control of the 20-year-old club in Tallahassee, Florida. Pope plans to address greens-related issues immediately and to completely overhaul Summerbrooke’s 18-hole, Dean Refram-designed course over the next three years. “He is like an angel,” Summerbrook’s owner, Reagan Hobbs, told the Tallahassee Democrat. “His forte is turning around courses. He is what we needed.” Hobbs bought Summerbrooke in 2003 and says that it hasn’t had even one profitable year. He was forced to close the club in July due to what the Democrat calls “persistent operating debt.” Pope, which operates six other golf properties in Florida, replaced Hampton Golf Management.

In an attempt to create a destination-worthy venue, the new owner of a golf club in Boothbay, Maine has turned to one of Tom Doak’s former associates. Paul Coulombe has allotted $4 million for a makeover of Boothbay Harbor Country Club, a property he purchased earlier this year, after it failed to sell at an auction. The club features an 18-hole track whose original nine opened in 1921. “I want this course to become a destination course in Maine,” Coulombe told the Boothbay Register. “I hope my investment will spur others to invest in our region.” The work, which begins next month, will be overseen by Bruce Hepner, an architect with minimalist sympathies who operates out of an office near Doak’s in Traverse City, Michigan. Hepner says that his goal is to make the course “strategic, interesting, and playable.”

KemperSports has added one of the top golf properties in Illinois to its fast-growing portfolio of private clubs. The company has been hired to operate Bull Valley Golf Club, a 25-year-old property in exurban Chicago that narrowly avoided foreclosure last year. “There are not a lot of courses in Chicago that can match the character of what Bull Valley has,” Doug Hellman, a senior vice president at KemperSports, told the Northwest Herald. “We’ll make it well worth the effort to go the extra distance to get to Bull Valley.” Specifically, KemperSports has been directed to improve Bull Valley’s food and beverage offerings and to make the club “a premier destination for weddings and parties,” the newspaper says. “We’re focusing on events,” said Gary Rabine, who paid less than $2 million for the club in 2012, “and [Kemper is] going to take that to another level.” Bull Valley is the 15th private club in the Kemper Collection, a group that includes Prairie Club in Valentine, Nebraska; Hamilton Farm Golf Club in Gladstone, New Jersey; and Governors Club in Brentwood, Tennessee.

Rees Jones, whose career achievements include major awards from the American Society of Golf Course Architects and the Golf Course Superintendents Association of America, is about to be recognized for his service to golf by the Golf Course Builders Association of America. The GCBAA plans to award the Montclair, New Jersey-based designer with its Don A. Rossi Award at next year’s Golf Industry Show. “Rees has a unique opinion when it comes to building golf courses and believes courses don’t have to be long to be challenging or hard to be fun,” said Justin Apel, the GCBAA’s executive director. “He was ahead of his time, as this way of thinking has essentially become the mantra of the golf industry.” Jones, a golf course architect since 1965 and a son of Robert Trent Jones, has designed numerous courses in the United States and others in Canada, Mexico, England, China, Namibia, Spain, and Puerto Rico, but he made his reputation -- and earned a nickname, “the Open Doctor” -- for the redesigns and remodelings he did at tracks that host the U.S. Open, the PGA Championship, the Ryder Cup, and other high-profile professional events. The ASGCA gave him the Donald Ross Award in 2013, and the GCSAA gave him the Old Tom Morris Award in 2004.

In coming years, we’re going to be deluged with messages reminding us that Scotland is “the Home of Golf” and inviting us to drop by for a visit. The promotions will be part of a national initiative, Driving Forward Together, whose goal is to make Scotland the world’s top golf destination by 2020. The campaign will be considered a success if it can increase the £220 million ($349 million) that golf currently contributes to the Scottish economy by 20 percent, to roughly £300 million ($476 million). “The collaborative approach between various organizations in pulling this strategy together is exactly what Scotland’s golf tourism sector requires,” said Tourism Minister Fergus Ewing, “and demonstrates that we are all working towards one single aim: to make Scotland the must-visit destination for every golfer.” The campaign will be bolstered by three high-profile events -- the 2014 Ryder Cup and the Open Championships of 2015 and 2016 -- that will be played in Scotland.

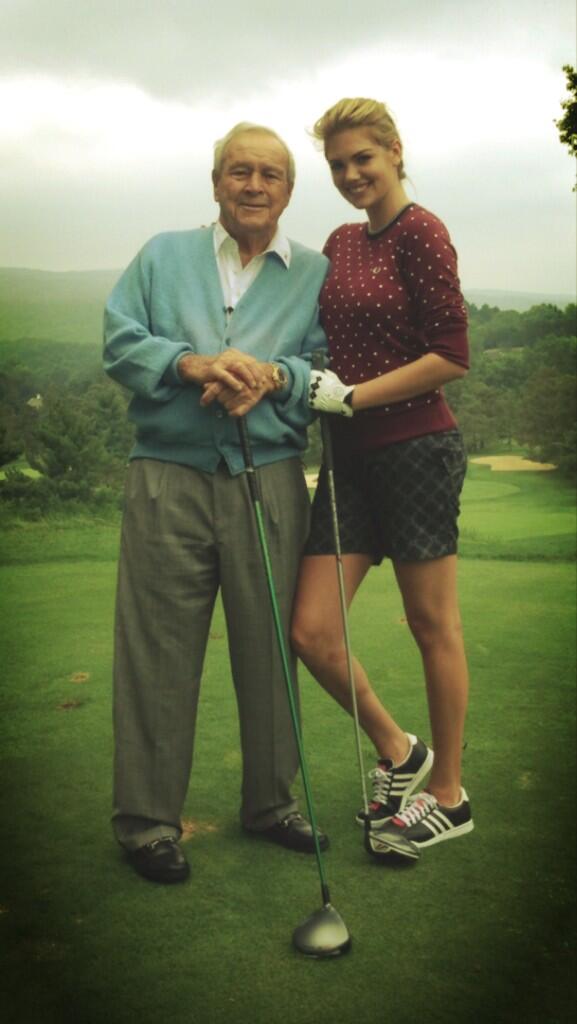

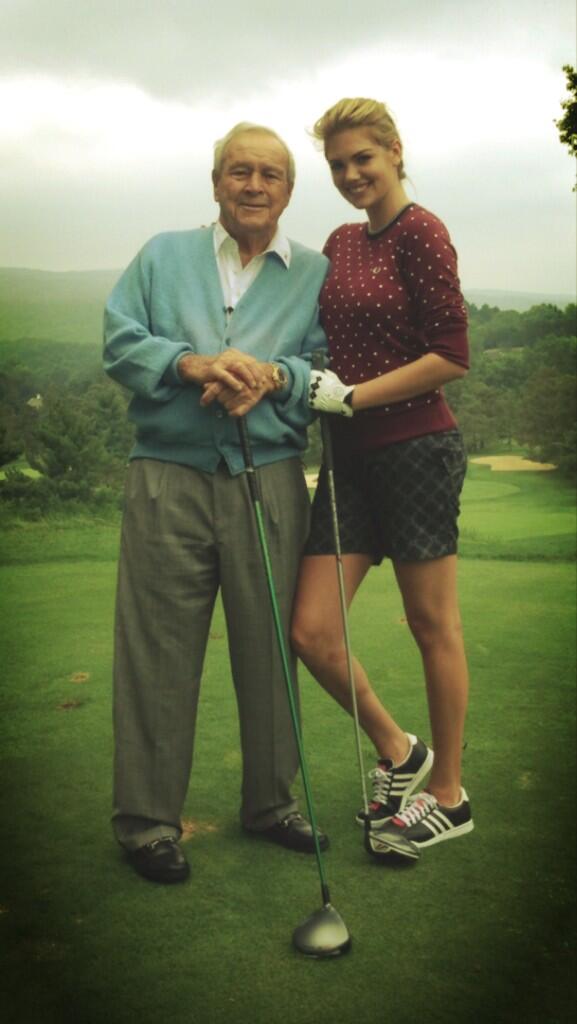

If a Canadian group’s calculations about net worth are accurate, Arnold Palmer and Tiger Woods are, among golfers, in a class of their own. Palmer is worth $675 million, according to The Richest, while Woods is worth $600 million. Greg Norman is a distant third ($300 million), followed closely by Jack Nicklaus ($280 million) and distantly by Phil Mickelson ($180 million). The rest of the top 10 looks like this: Fred Couples ($105 million), Ernie Els ($75 million), Vijay Singh ($65 million), Nick Faldo ($51 million), and Jim Furyk ($50 million). One surprise: Steve Williams, the caddy for Adam Scott (and, formerly, Woods), is said to be worth $20 million.

Friday, September 13, 2013

The Pipeline, september 13, 2013

A 537-acre spread adjacent to Flagstaff, Arizona’s Little America Hotel is slated to become the city’s largest master-planned community. Little America Hotels & Resorts, a company founded by the late Robert Earl Holding, believes the property can accommodate 1,415 houses, a second hotel with meeting space, a retail/commercial area, and an 18-hole golf course. The venture is no sure thing, as residents in the area have raised concerns about the availability of water, but the head of a local citizens’ group told the Arizona Daily Sun that the developers “have bent over backwards to allow the community to be involved.” Holding, who grew up poor during the Great Depression, was worth $3.2 billion when he died in April, according to Forbes. He owned Sinclair Oil Company, the Sun Valley ski resort in Idaho, four Little America hotels, and a huge cattle ranch that occupies parts of Wyoming and Montana. Forbes believes that Holding’s son Stephen will run the business.

Billy Casper Golf is trying to persuade government officials in Hendry County, Florida to endorse its plan to build a municipal course in the city of LaBelle. BCG has pitched a proposal to build and operate an 18-hole, Jerry Lemons-designed track with a short-game practice area. It thinks the facility will attract 41,000 rounds a year and generate $1.2 million in revenues against annual maintenance costs of just $450,000. Some of the county commissioners are receptive to the idea -- “The businesspeople of LaBelle want to do this,” one of them insisted at a public meeting -- but others fear that Casper’s estimates are pie in the sky. “These numbers just don’t add up,” a commissioner groused, noting that the municipal course in nearby Clewiston gets “more like 15 to 16,000 annual rounds.” The Clewiston News reports that the matter will be discussed again in the future. BCG is hoping to open the course by the end of 2014.

Earlier this year, Robert Trent Jones, Jr. was in northern Argentina, slinging bon mots and posing for photographers at the ceremonial groundbreaking for a municipal golf course he’s designed in Termas de Rio Hondo. “My goal is to make a course that golfers from all over will want to play,” he said at the event. Golf Club Rio Hondo, Jones’ first course in Argentina, is part of an economic-development effort taking place in Santiago del Estero Province. The province, Jones later explained, is “a poorer section of the country that’s regenerating” with a new airport, a new auto race track, and, before too long, his new golf course. It hopes these attractions, when combined with the popular hot springs in Termas de Rio Hondo, will generate tourist traffic and create jobs.

Angel Cabrera, the professional golfer from Argentina, is transforming a golf course near Punta del Este, Uruguay into his first “signature” design. Cabrera’s re-invented Los Tajamares Golf Club, which will stretch to more than 7,000 yards, is expected to open in early 2014. “My goal is to create one of the world’s best golf courses on a unique property in partnership with an owner who shares a special vision,” Cabrera said. The owner is Alejandro Bulgheroni, an Argentine who aims to bring a touch of Tuscany to his 10,000-acre Agroland estate in the village of Garzon, Maldonado. Bulgheroni is growing vineyards and olive trees on his property, along with almond, pecan, and chestnut trees. The golf construction is being done by Landscapes Unlimited, a U.S. firm, with local contractors. Punta del Este, the center of a vacation area that’s been called “the St. Tropez of Uruguay” and “the Riviera of South America,” is also where Las Piedras, a community featuring an Arnold Palmer-designed course, is under construction.

Treading water since 2008, the planned Paul Lawrie “signature” golf course near Donald Trump’s resort in Aberdeenshire, Scotland has again bubbled to the surface. Muir Group recently told the Aberdeen Evening Express that development plans have been prepared and that it expects local officials to rule on the project this fall. “Despite the current economic climate,” Ronnie Muir said, “the Muir Group remains wholly committed to its delivery.” Lawrie’s 7,400-yard, par-73 course will take shape at Blairs College, an ancient, ramshackle property that Muir plans to transform into a community with 280 single-family houses (some of them “affordable” units) and an upscale hotel with meeting space. Lawrie, who lives within eyesight of the abandoned college, believes the course will be worthy of hosting an event on the European Tour. “I have lots of ideas and am itching to get started on my first course design project,” he says on his website. Lawrie will co-design the course with Robin Hiseman, an architect from Berkshire, England-based European Golf Design.

The original version of the preceding post first appeared in the July 2013 issue of the World Edition of the Golf Course Report.

Before the end of the year, Erik Larsen expects to break ground on his first major project since leaving Arnold Palmer’s design firm in 2011. The new owners of Selva Marina Country Club in Atlantic Beach, Florida have appointed him to raze the property’s existing layout and replace it with a 6,815-yard track. Rick Wood, the leader of the new ownership group, told the Florida Times-Union that the community, to be renamed Atlantic Beach Country Club, will be “the perfect place for families or empty nesters seeking an active, beach lifestyle in a quiet, close-knit community.” Larsen, a former president of the American Society of Golf Course Architects, expects to unveil the new course roughly a year from now. Selva Marina’s E. E. Smith-designed course, which opened in 1959, was built on property that was once home to Atlantic Beach Golf Course, a venue that closed during World War I. Smith’s track formerly hosted the Greater Jacksonville Open, the event that became The Players Championship.

A South Korean group has agreed to build what’s been called the “biggest and most expensive tourism project” in the Subic Bay area. Resom Resort Company plans to build Subic Resom City on 750 acres in the Subic Bay Freeport, the former U.S. naval base that’s been converted to civilian uses. The Subic Bay Metropolitan Authority, which controls development in the area, expects the company to produce a “world-class” destination that will include a casino, overnight accommodations and vacation housing, several hotels, a theme park, a water park, a duty-free shopping area, a wellness center, a spa, and a championship-caliber golf course. Resom is no stranger to the golf business. The company owns a golf course in Shandong Province, China, and one of its three resorts in South Korea -- Resom Ocean Castle on Anmyeondo Island -- has a golf course. Subic Resom City is expected to open in 2017 or 2018.

The original version of the preceding post first appeared in the July 2013 issue of the World Edition of the Golf Course Report.

A Hong Kong-based casino company wants to buy property on Hengqin Island, Macau’s sparsely populated next-door neighbor, and it may build a golf course on part of it. Galaxy Entertainment Group, Ltd. owns and operates a handful of casinos and hotels on Macau, the world’s most popular gambling destination, including the Galaxy Macau on the Cotai Strip and the StarWorld Hotel & Casino. Lui Che Woo, the company’s wealthy founder, recently committed nearly $8 billion to expand his leisure-related operations, and he hopes to spend part of the money on a non-gaming resort on Hengqin. No details have been released, but Galaxy officials appear to have golf on their minds. “We believe what we can develop on Hengqin Island will be very complementary, whether it’s a golf club, a golf resort, golf course, or other amenities,” the firm’s CFO told the Macau Business Daily.

The original version of this post first appeared in the June 2013 issue of the World Edition of the Golf Course Report.

Swan Golf Designs, a British firm, has been commissioned to design a golf course for a planned resort community outside Kunming, the capital of Yunnan Province, China. As is its habit, unfortunately, Swan isn’t willing to share any important details related to the unnamed resort or explain how it could be built in the presence of a moratorium on golf construction. In a press release, the firm reports that the community will take shape in Mile, roughly 50 miles southeast of Kunming, and that the course will have “a traditional golfing theme,” unlike the “the American resort style of course that dominates China’s existing golfing stock.” It appears that the rest of the property has adopted the American style, however, as it’s been master-planned to include houses, a hotel, and the obligatory spa. Construction could start later this year.

Billy Casper Golf is trying to persuade government officials in Hendry County, Florida to endorse its plan to build a municipal course in the city of LaBelle. BCG has pitched a proposal to build and operate an 18-hole, Jerry Lemons-designed track with a short-game practice area. It thinks the facility will attract 41,000 rounds a year and generate $1.2 million in revenues against annual maintenance costs of just $450,000. Some of the county commissioners are receptive to the idea -- “The businesspeople of LaBelle want to do this,” one of them insisted at a public meeting -- but others fear that Casper’s estimates are pie in the sky. “These numbers just don’t add up,” a commissioner groused, noting that the municipal course in nearby Clewiston gets “more like 15 to 16,000 annual rounds.” The Clewiston News reports that the matter will be discussed again in the future. BCG is hoping to open the course by the end of 2014.

Earlier this year, Robert Trent Jones, Jr. was in northern Argentina, slinging bon mots and posing for photographers at the ceremonial groundbreaking for a municipal golf course he’s designed in Termas de Rio Hondo. “My goal is to make a course that golfers from all over will want to play,” he said at the event. Golf Club Rio Hondo, Jones’ first course in Argentina, is part of an economic-development effort taking place in Santiago del Estero Province. The province, Jones later explained, is “a poorer section of the country that’s regenerating” with a new airport, a new auto race track, and, before too long, his new golf course. It hopes these attractions, when combined with the popular hot springs in Termas de Rio Hondo, will generate tourist traffic and create jobs.

Angel Cabrera, the professional golfer from Argentina, is transforming a golf course near Punta del Este, Uruguay into his first “signature” design. Cabrera’s re-invented Los Tajamares Golf Club, which will stretch to more than 7,000 yards, is expected to open in early 2014. “My goal is to create one of the world’s best golf courses on a unique property in partnership with an owner who shares a special vision,” Cabrera said. The owner is Alejandro Bulgheroni, an Argentine who aims to bring a touch of Tuscany to his 10,000-acre Agroland estate in the village of Garzon, Maldonado. Bulgheroni is growing vineyards and olive trees on his property, along with almond, pecan, and chestnut trees. The golf construction is being done by Landscapes Unlimited, a U.S. firm, with local contractors. Punta del Este, the center of a vacation area that’s been called “the St. Tropez of Uruguay” and “the Riviera of South America,” is also where Las Piedras, a community featuring an Arnold Palmer-designed course, is under construction.

Treading water since 2008, the planned Paul Lawrie “signature” golf course near Donald Trump’s resort in Aberdeenshire, Scotland has again bubbled to the surface. Muir Group recently told the Aberdeen Evening Express that development plans have been prepared and that it expects local officials to rule on the project this fall. “Despite the current economic climate,” Ronnie Muir said, “the Muir Group remains wholly committed to its delivery.” Lawrie’s 7,400-yard, par-73 course will take shape at Blairs College, an ancient, ramshackle property that Muir plans to transform into a community with 280 single-family houses (some of them “affordable” units) and an upscale hotel with meeting space. Lawrie, who lives within eyesight of the abandoned college, believes the course will be worthy of hosting an event on the European Tour. “I have lots of ideas and am itching to get started on my first course design project,” he says on his website. Lawrie will co-design the course with Robin Hiseman, an architect from Berkshire, England-based European Golf Design.

The original version of the preceding post first appeared in the July 2013 issue of the World Edition of the Golf Course Report.

Before the end of the year, Erik Larsen expects to break ground on his first major project since leaving Arnold Palmer’s design firm in 2011. The new owners of Selva Marina Country Club in Atlantic Beach, Florida have appointed him to raze the property’s existing layout and replace it with a 6,815-yard track. Rick Wood, the leader of the new ownership group, told the Florida Times-Union that the community, to be renamed Atlantic Beach Country Club, will be “the perfect place for families or empty nesters seeking an active, beach lifestyle in a quiet, close-knit community.” Larsen, a former president of the American Society of Golf Course Architects, expects to unveil the new course roughly a year from now. Selva Marina’s E. E. Smith-designed course, which opened in 1959, was built on property that was once home to Atlantic Beach Golf Course, a venue that closed during World War I. Smith’s track formerly hosted the Greater Jacksonville Open, the event that became The Players Championship.

A South Korean group has agreed to build what’s been called the “biggest and most expensive tourism project” in the Subic Bay area. Resom Resort Company plans to build Subic Resom City on 750 acres in the Subic Bay Freeport, the former U.S. naval base that’s been converted to civilian uses. The Subic Bay Metropolitan Authority, which controls development in the area, expects the company to produce a “world-class” destination that will include a casino, overnight accommodations and vacation housing, several hotels, a theme park, a water park, a duty-free shopping area, a wellness center, a spa, and a championship-caliber golf course. Resom is no stranger to the golf business. The company owns a golf course in Shandong Province, China, and one of its three resorts in South Korea -- Resom Ocean Castle on Anmyeondo Island -- has a golf course. Subic Resom City is expected to open in 2017 or 2018.

The original version of the preceding post first appeared in the July 2013 issue of the World Edition of the Golf Course Report.

A Hong Kong-based casino company wants to buy property on Hengqin Island, Macau’s sparsely populated next-door neighbor, and it may build a golf course on part of it. Galaxy Entertainment Group, Ltd. owns and operates a handful of casinos and hotels on Macau, the world’s most popular gambling destination, including the Galaxy Macau on the Cotai Strip and the StarWorld Hotel & Casino. Lui Che Woo, the company’s wealthy founder, recently committed nearly $8 billion to expand his leisure-related operations, and he hopes to spend part of the money on a non-gaming resort on Hengqin. No details have been released, but Galaxy officials appear to have golf on their minds. “We believe what we can develop on Hengqin Island will be very complementary, whether it’s a golf club, a golf resort, golf course, or other amenities,” the firm’s CFO told the Macau Business Daily.

The original version of this post first appeared in the June 2013 issue of the World Edition of the Golf Course Report.

Swan Golf Designs, a British firm, has been commissioned to design a golf course for a planned resort community outside Kunming, the capital of Yunnan Province, China. As is its habit, unfortunately, Swan isn’t willing to share any important details related to the unnamed resort or explain how it could be built in the presence of a moratorium on golf construction. In a press release, the firm reports that the community will take shape in Mile, roughly 50 miles southeast of Kunming, and that the course will have “a traditional golfing theme,” unlike the “the American resort style of course that dominates China’s existing golfing stock.” It appears that the rest of the property has adopted the American style, however, as it’s been master-planned to include houses, a hotel, and the obligatory spa. Construction could start later this year.

Sunday, September 8, 2013

The Week That Was, september 8, 2013

The 21st century was supposed to be India’s century, the time when the nation became a global economic power and its golf industry took off like a rocket. Today, just 13 years into the new millennium, India’s economy is in “disarray,” according to the New York Times, “with the prospect of worse to come in the next few months.” Clearly, now is not the time to bet heavily on the prospects for golf development in the world’s largest democracy, no matter what the self-promoters and others with vested interests say. The Times reports that India’s real estate markets are “teetering,” its infrastructure is a wreck, good jobs are getting hard to find, the price of diesel fuel -- “the lifeblood of the Indian economy” -- is expected to spike, and, thanks to runaway inflation, many coveted goods (automobiles and electronics in particular) now cost more than many prospective buyers can afford. What’s more, since May the value of the rupee has fallen by 20 percent against the U.S. dollar, a fact that has implications for every sector of the nation’s economy, including its golf sector. In the face of such evidence, why would anyone believe that India’s golf industry is about to flourish?

India’s faltering economy has claimed its first golf victims: the Avantha Masters, the nation’s richest golf event, and the Kensville Gujarat Challenge, a stop on the European Challenge Tour. Neither tournament will be played in 2014. The cancellations could cost the Professional Golf Tour of India more than 40 percent of its prize money, according to the Times of India. One other thing: Next year, for the first time since 2009, India won’t host a event on the European Tour.